IDBI Credit Risk Fund(G)-Direct Plan

View the regular plan of this scheme

Rs 17.5542 -0.0014(-0.008 %) NAV as on 28 Jul 2023

Scheme Objective: The investment objective of the Scheme is to generate regular income and opportunities for capital appreciation by investing predominantly in AA and below rated corporate bonds across maturity spectrum. However, there is no guarantee or assurance that the investment objective of the schemewill be achieved.

Performance (As on 28 Jul 2023)

| 1 week returns | 3 month returns | 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|---|---|

| Scheme | 0.08 % | 1.37 % | 3.51 % | 7.09 % | 10.08 % | 3.82 % | N/A | >

Portfolio

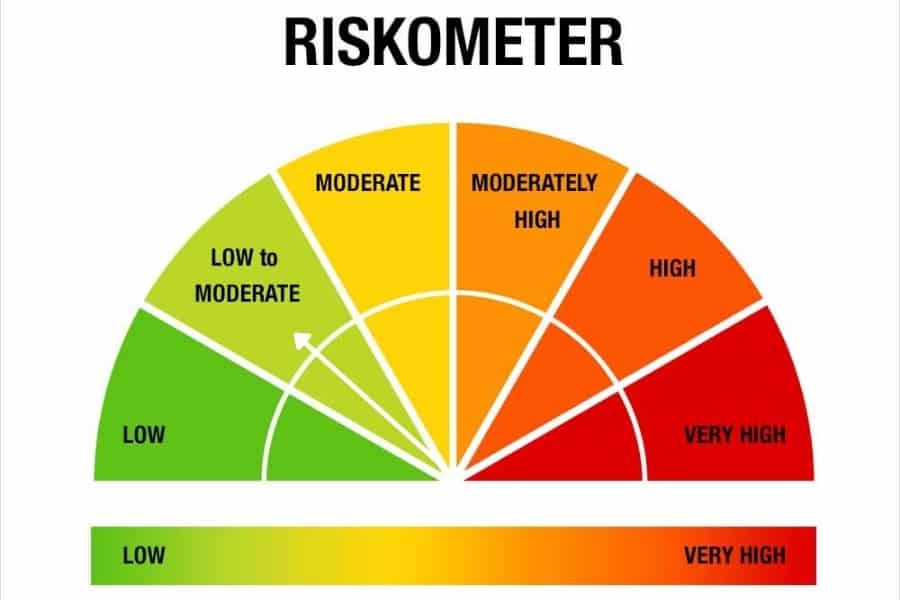

Credit risk debt funds invest at least 65% of their portfolio in debt instruments rated below AA+. As such instruments carry higher coupons, returns from these funds are generally higher than other debt categories. These funds, however, carry very high risk. While returns may not be volatile, as low-rated instruments are seldom traded, the risk comes from write-offs due to downgrades in the debt papers or defaults in repayment. Average maturities for these funds may be short at around 2 years but may go higher. Even so, these funds need to be held only with a long horizon as this gives a buffer in the event losses due to downgrades and defaults.

These funds suit high-risk investors with at least a 3-year holding period. Investors need to be able absorb shocks of losses. They are not alternatives for fixed deposits and fit only long-term portfolios.

For investments made before April 1st, 2023

Short-term: Holding period is less than 36 months.

Taxation: Capital gains are taxed at individuals slab rate

Long-term: Holding period is 36 months or more.

Taxation: Capital gains are taxed at 20% with indexation benefit.

For investments made on and after April 1st, 2023

All capital gains are treated as short-term capital gains irrespective of holding period and will be taxed at individuals slab rate.