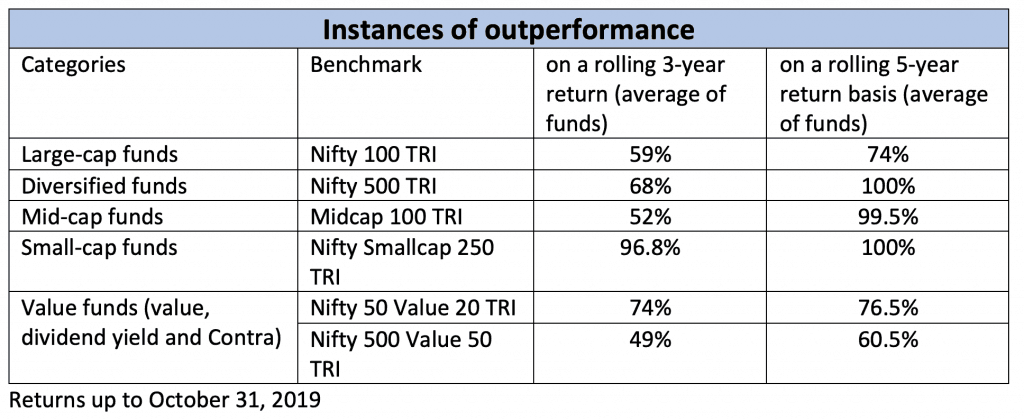

The answer is no. There will definitely be more space for index investing in your portfolio but that doesn’t mean you can ignore active funds. We’ll show you some numbers on Indian active funds’ ability to beat the indices currently.

In recent years, a series of events have led to increased awareness of index funds:

- The regulator increasingly pushing manufacturers to reduce costs and encouraging investors to opt for low cost products

- Significant increase in global inflows in ETFs

- Select stocks in the Indian markets moving to newer heights, naturally pushing indices up but having little to no impact on the wealth of those who held certain categories of active equity funds.

This article won’t get into the above trends. Instead, we will look at the performance of mutual funds in recent years vis-à-vis indices to make the case for why active investing is still needed.

A few notes on what we did:

- We avoided very long periods for the simple reason that much water has flowed post 2008. Pre-2008, you could throw a dart and be reasonably sure the fund you picked outperformed the index. Active investing beat indices comfortably over 15-20-year periods and the returns of very dated periods skews the averages.

- Therefore, we kept to a maximum of 10 years. So, 3 years returns were rolled daily for 5 years (that makes it a total 8-year period) and 5-year returns were rolled daily for 5 years (so a total of 10 years from 2009). This period is also important as mutual funds did not have it easy both regulatorily and otherwise in many ways.

- For the said 3- and 5-year periods, daily averages of fund return in each category were taken and compared with the indices we benchmarked them against.

- We clubbed the large & mid, focused and multicap categories (called diversified in this article) as there isn’t must difference in their investing styles. Also, much of these historical returns were pre-SEBI categorization (2018) when they all had similar market-cap styles. We kept value, dividend yield and contra separate to compare them with their appropriate benchmarks.

- We considered regular plans, as direct plans do not have full data for the period considered. Also, the idea is to see how funds perform with full expense loaded in them.

What the averages mask

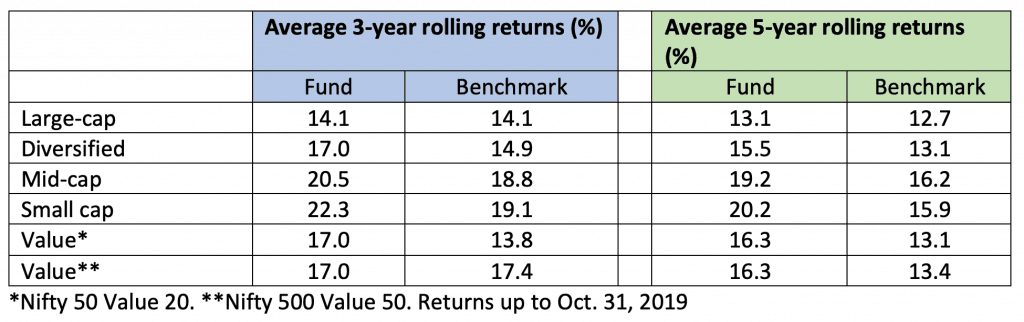

The two tables above don’t paint active funds in a bad light except in a couple of cases. But looking at just averages can be misleading even though we’ve avoided taking longer periods where returns were high. Therefore, let’s look at the details category-wise.

Largecaps may be losing the plot

The large-cap fund category’s 5-year average return has been underperforming the Nifty 100 TRI by an average 0.4% annualized since June 2018 (when the underperformance trend started). This gets more acute over 1 and 3-year periods. The next check we did was whether large-cap funds are at least containing downsides better. Downside capture ratio tells whether funds fall less than the index, when indices fall. Our rolling 1-month (over 3 years) data tells that only half the universe of large-cap funds did better than the index.

Next, we tried to see if there are at least enough winning funds that you can pick. Unfortunately, just 1 in 4 funds manage to beat the Nifty 100 TRI over 3- and 5-year time frames. That means the odds are against your hitting upon right fund to beat the benchmark.

Verdict: There is a growing case for substituting large-cap funds with other options. Please read our article on this changing trend and what to do: https://www.primeinvestor.in/2019/11/08/large-cap-funds-are-losing-the-appeal/.

PrimeInvestor will have investible ETFs and index funds other than the commonplace Nifty 50 to play this space better in our Prime list of recommendations. We will also highlight the few superior large cap funds in this space.

Diversified funds for all seasons

This category beat the benchmark by 2.1 percentage points on an average for 3-year periods. However, the 3-year returns since June 2018 has been marginally underperforming the index, though it is not as pronounced as large caps. It is also clear that fund managers are staying away from ‘expensive quality’ or limiting weights to them. This is one reason for their recent underperformance.

But there isn’t a dearth of funds to outplay the index, unlike the large-cap space. 1 in 2 funds beat the index two-thirds of the time on a rolling 3-year basis. Better still, on a rolling 5-year basis, 2 in 3 funds beat the index over 80% of the time. This clearly establishes that there is a clear case for active investing in this category.

Not just that, the category’s record in delivering consistently superior returns is also high. For example, 79% of the time, they delivered returns above 12% on a 5-year rolling basis. The Nifty 500 TRI delivered such returns just 60% of the time.

The third positive feature is that the category provides various styles of investing. Choosing differentiated styles will ensure that one or the other of your funds will be outperforming in different cycles. For example, a value conscious diversified fund from a small but well-known fund management house with a dash of international exposure combined with a growth strategy from a nimble AMC or a momentum play from a lesser known fund house can balance your portfolio better than one market-cap based index.

On the index front in this space, as things stand today, there is just one index fund on the Nifty 500 index and one ETF on the S&P BSE 500. The Nifty 500/ BSE 500 are not to be confused with the structure of the S&P 500, which is a US market index and sports a far better mix of sectors and stocks (Here’s our review of the Motilal Oswal S&P 500 index fund).

Our sense is that filtered versions of the Nifty 500 (factor-based) may kick in soon. But it is clear that fund houses do all the factor-based investing possible in the active segment of this category and there is enough variety and funds to choose from.

Verdict: There is a very clear case for active investing in this space. This segment can also be a substitute for large caps given the ability of many funds in this space to contain downsides and deliver returns.

Midcaps still manage

The3-year returns in this category beat the benchmark comfortably. By their very structure (an index is purely into midcaps while a fund can have small proportion in large caps or cash), their ability to contain downsides has ensured outperformance.

However, there is a stark divergence in the performance of the universe in recent times, like large caps. Post SEBI’s categorization in 2018, mid-cap funds may have seen a change in their investment universe, wherein what AMCs considered as midcaps became small caps (as defined by SEBI). But the bigger issue is that the midcap rally until 2017 left some of these funds with burgeoning assets that had to be effectively deployed. And if initial signs are anything, some of the funds with larger AUMs are showing signs of strain. This essentially means it is not easy picking funds in this category.

In the index space, while funds comfortably beat Midcap 100, new and emerging indices such as Midcap 150 provide stiff competition. But the index may be suitable only for very aggressive investors.

Verdict: The bottom line here is that, for a long-term portfolio, an active fund from this category or from small caps is a must to provide kicker to your portfolio. But choosing the right fund will not be as easy as it is in the diversified fund category.

Small caps cannot be swapped

This is one category where the fund manager’s skills show up. We don’t think there will be any indices any time soon to replace this. Whether it is the Nifty Smallcap 100 or the tougher Nifty Smallcap 250, small-cap funds score every time.

9 out of 14 funds in this category beat the benchmark over 80% of the times when returns were rolled for 3-year periods.

And while index supporters might say that this category contains downsides better only because they do not hold 100% small-caps, we think that is why investors need to go to a fund manager in the first place. For an investor to take cash calls or to shift market caps and incur capital gains to do so deftly, in the Indian context (cost and tax), is simply not efficient nor feasible.

Verdict: You need active small-cap funds to build wealth. There appears no substitute at this stage for this.

Value, waiting to be picked

Apart from showing the numbers, I do not wish to get into a debate on value vs quality in the Indian context and whether value funds are underperforming, as we will digress. While value traps may be harder to overcome in indices than active fund styles, it is heartening to know that value strategies, especially if combined with other factors, can deliver. More about it when we talk about recent index funds, emerging indices and possible ETFs in this space.

What these numbers tell us

We have put out just a couple of the many factors that we look at when we compare funds with indices during our rating and recommendation cycles. They key takeaways from our numbers are this:

- While the number of funds underperforming the benchmark is worrisome in large caps, in all other cases, there are enough options that makes active investing worthwhile. In fact, the above averages would be higher save for a few funds that account for probably less than 2 percent of the AUM.

- However, with a larger universe of funds, it is not going to be easy for investors to spot the funds that are improving or the funds that are going down. Read our article on https://www.primeinvestor.in/2019/10/31/is-buy-and-hold-a-sound-strategy-for-mfs/

- It has and will be more challenging for retail investors, especially those who have been confidently picking their own funds to mix funds with right strategies to deliver.

- Understanding of individual fund strategies and how they play will be crucial to picking good funds.

In this regard, it is important for investors looking at big names in the MF space or index supporters criticising the big names (the only ones they know) – to look deeper, as the landscape has changed. It is important to spot smaller, nimble, less flashy names that have quietly been doing their job with élan.

Investors have a choice between doing or seeking quality research and advice or simply calling active funds as ‘sour grapes’. But for those who do, here’s a sample of what good active funds can deliver just over a 5-year period, if you are a SIP investor:

Returns as of Oct. 31, 2019

Postscript

While we mentioned some reasons for the increasing interest in index funds, it is also partly to do with the poor advice (sometimes mis-selling) that some investors have experienced. This can be a very valid reason to decide to simply hug the market than take active calls that go wrong. However, it is not necessary that you stay away from good opportunities to build wealth.

At PrimeInvestor, we consider both passive and active strategies. The present team has been engaging in talks with fund houses about the need to have more low-cost semi-active products for the past 2 years. The team has back tested many of the factor indices in India and tried various combinations on what works in the Indian context.

We are now again sharing and understanding strategies with fund houses that see a need to build passive or semi-active strategies for the long term. Our overall objective is to see how optimally an investor can build wealth, without losing out on good options – active or passive. It need not be either or. And as things stand today, it is certainly not ‘all passive’.

Index Talk in India

In the last 2 years of regulatory changes both with respect to cost structure and investment framework, we see some extreme views on investing and advisory.

- Anybody who advocates active investing is seen to be after money or commission.

- Anybody who provides free advice or calculations must always be right.

- Recommending index investing is a must to establish one’s moral status or values

I will stop with saying the above views are a bit myopic if not dangerous.

There is also this belief that fund returns look alike with time, so one might as well go with low cost. Going with index funds is not at all wrong and is a strategy by itself but the reasoning that is often presented is not true. Quality funds can make a difference to your wealth as can be seen in the SIP table in this article.

Unfortunately, many investors who read the index bibles and advocate it, fail to see the pitfalls that Indian investors are confronted with in the Indian market (in contrast with what’s seen in the US market). Here are some:

- Index funds are not always low on cost save for the Nifty 50. The cost of Next50 or an equal weight index is closer to the 1% mark. Besides, investors are often unaware that the tracking error in these funds can be significant and that there are some abnormally high cost index funds.

- Worse still, ETFs (other than the Nifty, Junior Nifty and select Bank ETFs) suffer from poor liquidity and their market prices and NAVs are totally out of sync.

- There are very limited options today for ETFs or index funds to replace the varied strategies that funds use or the varied categories that SEBI has prescribed. ETFs such as low volatility or Value exist without being useful due to poor liquidity. Others such as equal weight pale in comparison to performance of their active counterparts.

- When global advisors (or NRIs investing in India using overseas vehicles) talk of index-based investing in Indian markets, they only see major indices such as the MSCI India indices. Those indices are much more deftly managed, and many are filtered on several factors including low volatility, quality or value. These do deliver well and exhibit lower volatility in some cases. Unfortunately, the Indian regulator permits only indices associated with our stock exchanges to be publicly available for investing.

Yes, you can seek to invest in the varied, exciting indices in other markets. But for a normal retail investor in India, it is not yet that easy to tap the global market. Save for a Nasdaq 100 ETF and FoF or Hangseng, there aren’t any funds/ETFs that you can invest in, through the local fund route; unless you get directly into such ETFs through select brokerages. It may not also be affordable for a typical Rs 5000-10,000 per month retail SIP investor. That global investing is treated as debt investing for tax purposes in India, can also be a big put off for many ‘tax conscious’ investors.

11 thoughts on “Is it time to move from active funds to index funds?”

It has been seen that in the large-cap segment the current active mutual funds are finding it really difficult to beat the index and even the outperformance or the alpha as we call it is fast shrinking.

I have a basic question – Should I do a monthly SIP or Weekly SIP for index funds or MF in general. Does it make a difference?

Is begining of month or end of month for SIP is a better option? Any study?

It doesn’t make any material difference. So what is convenient to you. thanks, Vidya

Very insightful article on how active vs passive in all categories.

My understanding so far after reading index investing articles in blogs:

1. Index funds cost wise cheaper than active ,so this implies in the long run, performance of index fund is better than Active funds. ( like Same comparison of Regular vs Direct plans).

2. because of less commission , most of the advisors recommending Active funds than Index funds.

3. Every year Portfolio churn,Review of funds,selecting best fund are big headache for retail investor, so the ultimate choice is Index investing. (But still not clear about Tracking error part 🙂 )

Kindly share your views whether my understanding is correct. For normal Indian retail investor, it makes so confusing to choose which one better(active vs passive) to reach his/her life goals. The corpus is more important than return.

Sir, unfortunately you are seeing things in black and white. Most of reality is inbetween black and white and hence choices are and will always be difficult 🙂 We did not say all IFAs run behind commission, we did not say index funds is the only solution (if so why we wouldn’t recommend active funds 🙂 We did not say portfolio review is a headache. Some may find it to be. Vidya

Hello,

I think the above analysis would be more meaningful considering the post re-categorization period.

However, at the current time, since the post re-categorization period is too limited, much analysis is not meaningful.

Also, you have picked 2 funds, that may have done well. This can be influenced by survivorship bias. Perhaps it’s better to look at your own recommendations 5 years back (ie. look at the entire bucket – not cherry pick) and see the results.

Anyway, one area where I would be interested is in identifying undervalued opportunities – eg. currently, value has been out of favour, and mid caps and small caps have also not done well. Identifying and supporting such analysis with data would be a service that’s welcome. However, I’d need to see data to show whether this can add some alpha. Also, some analysis on the long term performance of the contra funds would be interesting.

Also, what’s your view on the PE ratio funds and the dynamic allocation funds, based on their performance?

Good luck!

K.

K,

Fact remains that largecap funds were underpforming pre and post categorization and among the other categories, midcap needs to be watched for impact of category change. All of what you mentioned will be analysed over the course of our subscription period, once we go live. PE and dynamic allocation funds stand below hybrid equity funds in terms of delivering over 3-5 year periods. In other words, you need to treat it like low-risk-retun equity product and not at par with equity.

thanks

Vidya

Please provide actionable inputs for value fund investors.

Hi, We will be covering those in our list of recommended funds. Once we go live, please subscribe to stay updated on when to hold value, when not to and how much to take exposure to this strategy. thanks, Vidya

Great write up arguing for coexistence of both index and active funds, more so in Indian context. Indian Market is yet to become so big, well regulated and populated with large number of great companies that active funds cannot beat indexes. But for retail investors, its increasingly becoming difficult to choose correct funds to meet their requirements and hence tend to hop from one fund to another looking at short term trends!!

Hello sir, Your observations are very true. We hope our products will solve the retail investor’s problem. Thanks, Vidya

Comments are closed.