In tough times such as this, it is hard to see your investment value dwindling. And when that happens to your debt funds, it is even harder. We’ve had quite a few queries on whether it is safe now to park money in liquid funds and very short duration funds and whether it should be withdrawn.

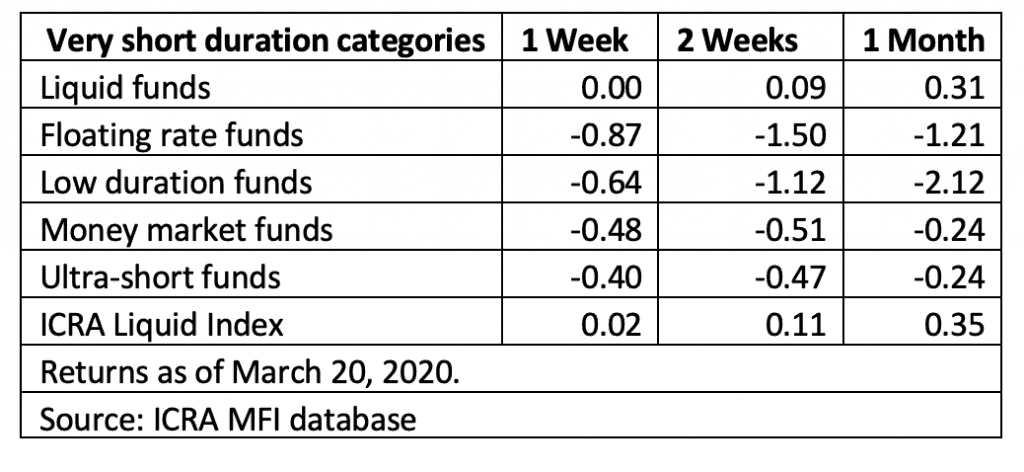

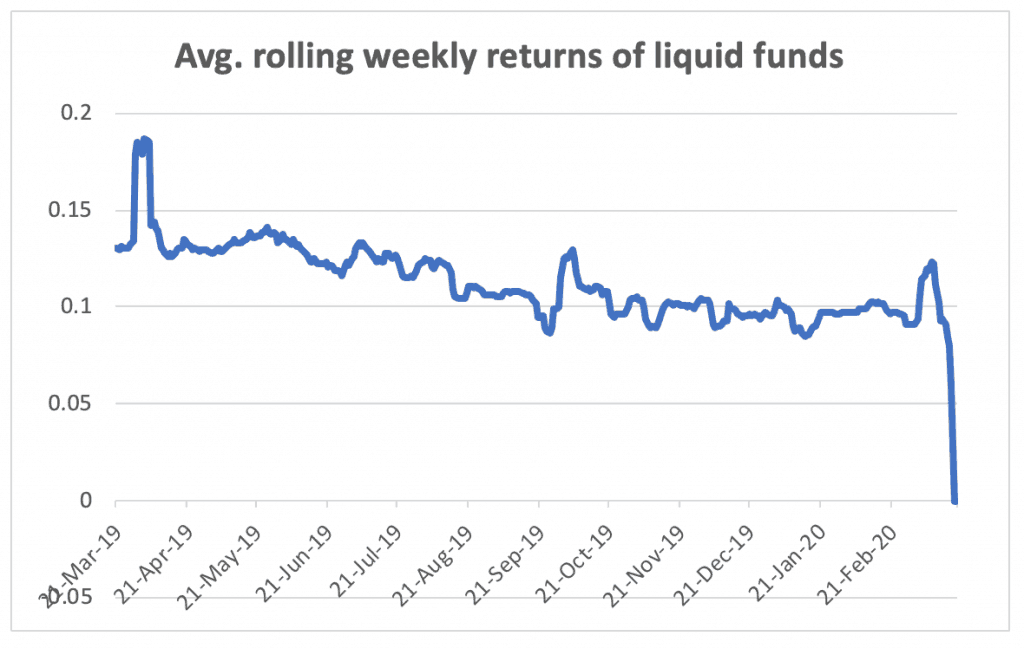

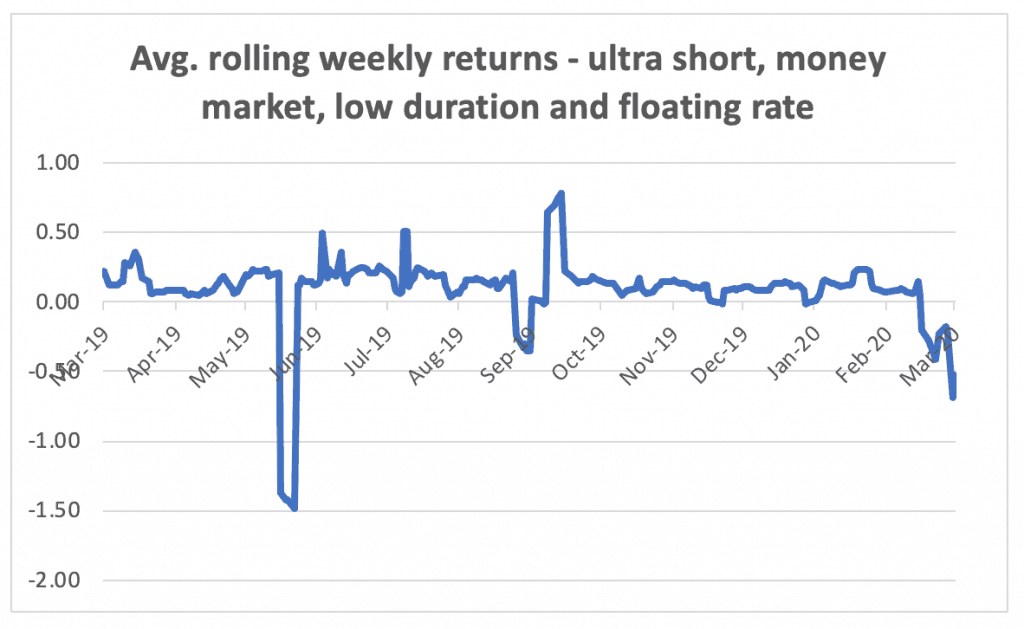

The questions come as a result of the falling returns that you see in the table below, in the past few weeks. The past week saw a dip in debt fund returns to the extent that liquid funds returns posted was their lowest weekly returns in the past year. Liquid funds returns for 1-week were essentially nil, and even saw 2-3 days of daily marginally negative returns. Other categories in the very short duration segment saw a drop in their returns. Why did this happen, and should you be worried about it? Read on.

Are you staying with good quality funds? Use our MF review tool to know whether to buy hold or sell your funds. All this and more with a PrimeInvestor membership. Sign up today for a free trial!

Looking for more such, well-researched, actionable insights? Sign-up for a FREE trial of PrimeInvestor today!

Before we proceed further, two things. One, we have only taken very short duration categories as the recent volatility stands out here. Volatility is a given in the other categories and we are not discussing them here. Two, it has not been easy gathering information on short-term debt volatility over the past week as these are not commonly traded instruments. We had to rely on fund manager calls and data on bond yield movements.

While it can be said CDs and CPs saw a 20-30 basis point spike in yields (and according to a fund manager, as much as 100 basis points) we cannot be sure what exactly caused this as there is very little public data available on these accrual instruments. Hence, our understanding is based on whatever we could gather and infer. Here’s what we believe has taken place over the past week that could be resulting in unusual volatility:

- The financial year end usually leads to redemption in liquid and short-term funds on account of advance tax payments. Most funds are prepared for this with sufficient liquidity in the instruments they hold. However, it is likely that this regular redemption has been compounded by withdrawals arising from tight liquidity and cash requirement in many companies and institutions in these abnormal circumstances. At such times, a fund manager is often forced to sell papers at lower prices causing yields to spike. Essentially, liquidity crunch causing yield hike.

- FPIs have not only been selling in the equity segment but have exited debt as well. In March month to date, according to SEBI data, the net sales in debt by FPI was Rs 46,962 crore, slightly higher than even equity. While a majority of this would be long-term, fund managers have been quoted stating that FPIs have been selling short-term instruments too.

- Come April 1, the new dividend distribution tax (DDT) regime will kick in. This will also mean that large investors may be shifting out of the dividend payout/reinvestment option into growth or simply decide to hold in FDs.

- More than half of the liquid funds have an average maturity of over 30 days. That means a good proportion of their securities are marked to market, leading to volatility. In 2019, SEBI introduced a rule that required funds to mark to market papers of over 30 days’ maturity.

All the above essentially puts pressure on the yields causing them to rise, pushing prices of instruments down. As far as we gather, there appears no ‘credit risk’ event that triggered fall for these categories of funds.

So, show this be reason for you to panic? Not as things stand now. However, it is important for you to know the following:

- From April 1, debt papers across maturities must be marked-to-market. That is, they need to move from an amortization method (where the difference between cost and maturity is spread over the tenure of the instrument) to market driven prices. Up until now, only papers that are over 30 days in maturity needed to be marked to market. This means there can be more volatility in categories such as liquid, low duration, money market and ultra-short, if the current yield volatility continues.

- If the covid-19 uncertainty continues in India for a few more weeks, corporate working capital cycles will likely dry up and companies will start digging into their short-term treasury money to keep payrolls and administration costs going. This could further mean redemption pressure for liquid funds returns.

- Continued FPI selling can also cause some more volatility.

- With cities such as Mumbai going to a lockdown, reduced dealer presence (despite financial markets running) could also mean less efficient prices for debt papers. Hence, inefficient pricing cannot be ruled out.

On the positive side:

- The RBI is continuing its open market operations (OMOs) to keep liquidity healthy. In downturns such as the present one, financial health of the debt markets will be crucial to ensure a quick turnaround, whenever it happens. The RBI is doing what it promised, with a Rs 30,000 crore liquidity infusion (to be done in 2 tranches coming week) and more expected over the weeks based on need. It is to be noted that the RBI has infused Rs 2.5 lakh crore of liquidity into the system since its last policy meeting about 6 weeks ago.

- Come April 1, SEBI’s new guidelines for liquid funds also require them to hold 20% in liquid instruments such as cash, treasury bills, government securities and repo of government securities. This will also ensure that liquid funds returns are better placed to meet redemption pressures.

What should you be doing now with liquid funds?

First, you need to cope with a bit more volatility with mark-to-market in debt funds (especially in liquid funds) kicking in. Second, the present volatility, despite all RBI efforts cannot be ruled out for a month or two. Third, while yields may seem attractive now, this is not a time for investors to be taking bets on yields with short term instruments. At this time, safety first.

- If you need cash over the next few weeks: keep this in your bank account and avoid investing afresh in liquid funds.

- If you don’t need cash for the next 2-3 months, and you have already invested in liquid/ultra-short/ other low duration funds: Expect volatility but do not worry too much . The volatility should eventually settle.

- If you’re looking to park short-term money now, do it in this order: make sure your immediate needs are met only with your savings bank account balance or short-term deposits that you can break. Then over night funds, liquid funds and ultra short/low duration/money market, in that order should be your channels of investing.

- If your bank balance is insufficient to meet expenses for the next few weeks, don’t let the return volatility stay your hand. Redeem liquid funds now and keep a reserve in bank. Lower rates in banks or marginal loss in your fund should not matter in such emergencies.

- In times such as the present one, the uncertainty of slowdown, losing a job etc. may start creeping in your mind. If you have an investible surplus now, first make sure you have enough emergency funds in your bank to meet next several weeks or months of expenses, depending on how volatile your job situation is. Invest only the remaining, whether you make such investments in debt or equity.

In general, with many of the new valuation and investment rules in place with debt funds, moderate your return expectations a bit with low duration funds.

Looking for more such, well-researched, actionable insights? Sign-up for a FREE trial of PrimeInvestor today!

2 thoughts on “Prime Views: Why are liquid funds returns falling and where should you invest?”

Much needed article at this point of time. What would you suggest if I have an exposure in a medium term bond fund , which has got around 65% exposure in AA papers.. The fund was doing well until a couple of weeks back and there is drop of around 3% in NAV in last 1 week…Looking forward to your suggestion..

Great. Thanks for all the details.

It is much more clear now.

Comments are closed.