Ramesh is an IT engineer who loves the experience of seeing new countries.

He visits a new country every year and he’s done so for over 7 years now!

But he slowly starts to notice that the price of his holidays increases every year. He’s puzzled. After a quick google search, he understands the concept of inflation.

He then looks at his savings account and realises that the money in his savings account is not growing at the same rate as inflation.

“If my vacation costs are going up by 7.66% every year and my money is growing only by 3% then as time goes by, I will not be able to afford my vacations anymore!”

He says “ENOUGH! I will not tolerate this any longer” and then he goes to his friend’s house.

He explains this inflation concept to his friend and realises that even his friend, Suresh, is facing the same problem. They decide to take action.

They find 8 other friends who have the same problem and then get on a conference call.

They then come up with a SUPER IDEA! 💡

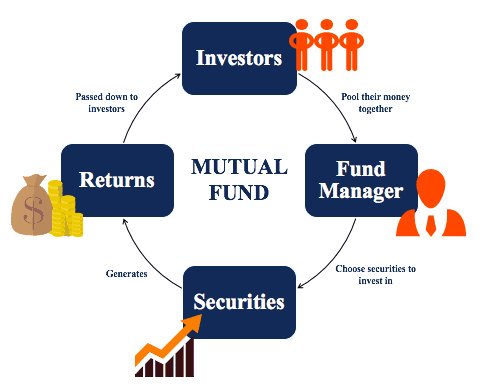

What are mutual funds? Mutual funds as an investment alternative has been gaining prominence over the decade. Since it is integral to gain more information about it before investing, this article seeks to act as a starting point in your mutual fund journey.

They decide to pool all their money and they hire a “Money Manager” to manage their money.

The money manager split the entire pool into 10 parts and assigned 1 part to each friend.

This money manager then took this money and bought a lot of different shares and bonds.

With those shares and bonds, he made a return of 20% after 1 year.

All 10 friends were happy.

All of their money grew by 20%.

Ramesh knew he didn’t have to worry about running out of money for his travels ever again.

In the above example,

The “Pool” of money that is invested in different stocks or bonds is called a FUND.

The “Money Manager” who manages other people’s money in real life is called a FUND MANAGER.

The total value of all the investments in the fund minus the costs involved in managing the fund is called the Net Asset Value (NAV).

If one of the stocks in the portfolio does well and the price rises, the NAV will also rise.

If one stock goes up by Rs500 and another stock goes down by Rs500, the NAV may remain the same. You get the idea.

Mutual Funds are not free. There are many associated costs involved in holding a mutual fund. These costs include the fund manager’s fees,operational and administrative expenses & brokerage fees. All these costs put together are called Total Expense Ratio (TER). It is generally in the form of a %. So if the TER is 1% per annum, it means the total cost of running the fund is 1%.

This cost is deducted before your NAV is declared.

A very important thing to note here is that TER is not deducted every year but every working day. So if the TER is 1% and there are 250 working days in that year, the NAV is reduced by 0.004% everyday (1/250).

The other cost that you visibly incur is the exit load. When you exit a fund within a recommended time frame (set by the scheme), you may be charged a load on your NAV called the exit load. This is meant to discourage short-term investing and churn.

Now let’s look at where your fund manager invests and makes your money grow.

What are mutual funds?

A mutual fund is an investment vehicle that pools money from a multitude of people (investors like you and me). It uses this pool to purchase securities like stocks, bonds, and gold. As the prices of securities change, the mutual fund scheme makes its returns which is in turn the investor’s return. Professional money managers with decades of experience manage each mutual fund and take the call on which securities to buy and sell. The mutual fund is managed in a manner consistent with its stated objectives.

How are returns made in a mutual fund?

A mutual fund invests in a basket of securities. As the prices of these securities change (for stocks and some bonds) or as a fund earns the interest on the bonds it holds, its value changes. Gain in stock/bond prices sends value higher and vice versa. So as the fund value moves up, your investment value also rises.

- When you sell your fund – In this case, you earn capital gain. Capital gain is the profit on your investment when you sell your mutual fund units. It is the difference between the market value of your mutual fund units at the time of sale and the cost of such units. The gains come in from the appreciation in your fund’s value. If the selling value is lower than your investment cost, you’ve made a capital loss.

- When you earn dividends on your fund – This happens when a mutual fund declares dividend out of the accumulated profits it has made. This accumulated profit can be in the form of securities sold for profit, interest earned on bonds, or dividends earned on stocks.

Dividend vs growth options

In the growth option of a mutual fund scheme, all profits made by the fund are ploughed back into the scheme. In the dividend option of a mutual fund scheme, the profits made by the fund are distributed to the unit holders from time to time. This dividend is deducted from the NAV and given back to you. Therefore, dividend in a mutual fund is simply your own investment coming back to you and is not additional returns made.

Why should you invest in a mutual fund?

There are a host of reasons!

Diversification: Diversification is one key advantage of investing in mutual funds. Diversification is a potent way of reducing risk and ensuring that a portfolio delivers across market cycles. When you invest in different stocks in different sectors, you’re spreading your investments out since each sector and stock behave differently and have different drivers. But it’s hard to do so when investing directly in stocks, since it is hard to buy a large variety of stocks.

When you buy a mutual fund, it gives you exposure to a large basket of stocks. It’s a cheaper and easier way to own a portfolio of stocks than by buying individual securities. And because a mutual fund is a big pool of money, and is professionally managed, it can build a well-diversified portfolio. Large mutual funds typically own hundreds of different stocks in many different industries. It wouldn’t be practical for an investor to build this kind of a portfolio with a small amount of money.

Professional Management: A primary advantage of mutual funds is not having to pick stocks and manage investments yourself, which requires both time and skill. Instead, a professional investment manager takes care of all this using careful research and skilful trading. A mutual fund is an inexpensive way for a small investor to get a full-time manager to make and monitor investments. Most private, non-institutional money managers deal only with high-net-worth individuals.

Variety and Freedom of Choice: You have a wide variety of mutual fund types to choose from. There are equity, debt, and gold funds, besides funds that invest in a combination of these. Each fund is managed in a different way, and there are multiple strategies. For instance, a fund manager may focus on value investing, growth investing, developed markets, emerging markets among many other styles.

Therefore, no matter what the risk level, time-frame, age or any other requirement, there will be a mutual fund that suits the purpose. In addition, the variety allows investors to gain exposure to different stocks, bonds, commodities, or foreign markets, as well as different methods of investing that helps build an all-weather portfolio.

Transparency: Mutual funds are regulated by the Securities and Exchange Board of India (SEBI). SEBI has been adept at protecting investor interest in mutual funds and ensuring best practices by AMCs. Over the years, SEBI has brought in and continues to bring in regulations that prevent AMCs from taking on undue risks, overcharging investors, making false claims and so on. Mutual funds also score on disclosures – a mutual fund needs to disclose its full portfolio and asset size every month, its expense ratio and NAV every day. At all times, an investor is aware of where their money is being invested.

Ease of investment: Investing in mutual funds spares the investor of the numerous commission charges needed to create a diversified portfolio and large transaction fees. This apart, mutual funds allow any investor to build wealth. Investments in denominations as small as Rs 500 can be made. In this way, even smaller investors can slowly build up their wealth and still own a well-diversified portfolio. Mutual funds allow investors to set up periodic investments such as every month, every week and so on. They also allow investors to withdraw on a periodic basis too.

Risks in mutual funds and how to use them

Risk here means the probability of you losing money in a mutual fund. As mutual funds are linked to the equity or debt markets, their NAV swings to the volatility in the price of the instruments they hold. This also means that there can be NO FIXED RETURNS in mutual funds. Returns are volatile.

Every category of mutual fund has a different level of risk. You have to choose a mutual fund based on the fund’s inherent risk characteristics and also how much risk you can handle. A very important thing to know here is higher the risk, higher the potential return AND higher the potential of losses.

Given below are articles that will help you understood how to choose different categories of mutual funds based on their risk profile and your time frame:

Frequently-used terms in mutual funds

There are a lot of words thrown around when the topic of mutual funds crops up. But they aren’t as hard as they sound; here are the basics.

NAV (net asset value)

The price of one unit of a mutual fund or one share of a mutual fund. NAV is calculated by dividing the total market value by the total number of units after taking into account the expense ratios. The NAV reflects the value of the securities in the portfolio. It is influenced by the market price of the securities in the portfolio and how much of the security the scheme holds. The change in NAV over a period will tell you what the fund’s gain or loss is and it is this performance which is crucial to deciding whether or not to invest in a fund.The absolute NAV does not matter.

Fund category

A fund category is a classification to put similar funds together. For example, all funds that invest primarily in large-cap stocks will fall under the large-cap category. The table gives the list of mutual fund categories, as defined by SEBI. A fund (whether equity, debt, or hybrid) should be able to beat its category average on a consistent basis for it to be called a good performer.

Benchmark

A benchmark is a stock market or bond market index whose returns the fund aims at beating. The benchmark is a reference point against which the performance and stock allocation of a mutual fund scheme are compared.

Expense ratio

This is the fee that you will be paying the AMC on an annual basis. NAV and returns of a fund are calculated after factoring in expense ratios. SEBI regulates and limits expense ratios that funds can charge besides defining what expenses an AMC can charge to a fund.

Fact sheet

A mutual fund fact sheet is an essential document that is designed to give an overview of the mutual fund and its performance. It is beneficial for potential investors to go through this report to analyse and evaluate a mutual fund scheme and learn the pros and cons of the same.

Exit load

Exit load is a fee charged from an investor for exiting or leaving a scheme before a defined period. The intent is to discourage investors from making frequent redemptions, which can tend to make fund management hard or hurt other investors in the scheme. Different mutual fund charge different fees as an exit load, and it is not necessary for a fund to have an exit load. When you sell your fund in the exit load period, the load is deducted from your proceeds and the remaining amount is credited.

Scheme Information Document

This is a comprehensive document containing fund information such as investment objective and policies, asset allocation pattern, fees and liquidity provisions. It contains details of the fund manager and his team, risk factors, and other information.

Broad variants of mutual funds

Regular and direct mutual funds

A Direct plan is when you buy directly from the mutual fund company without involving a distributor. There are several platforms on which you can buy direct plans of mutual funds, in addition to an AMC’s website.

A Regular plan is when you use the services of a distributor or an agent, to whom the AMC pays a commission. This commission forms part of the expense ratio of a regular mutual fund. For this reason, a regular plan has a higher expense ratio than the direct plan and will generate lower return.

Active and passive mutual funds

In an actively managed fund, the fund manager picks securities with the aim of beating the benchmark. Securities in an active portfolio and their weights in the portfolio will differ from that of the benchmark index. In a passive fund, the fund manager simply replicates the index with exactly the same stocks and in the same proportion. The aim is to deliver only market returns and not beat it. Index funds and ETFs are passive funds.

Open ended and close ended funds

An open ended mutual fund allows investors to invest in and redeem from a fund at any time. The fund therefore receives perpetual inflows and redemptions. Investors are allotted units at the NAV prevailing at the time of investment.

A closed-end fund is open for subscription only for a defined period, and investments need to be made only in this period. Closed-end funds also have a maturity date, before which investors cannot redeem their investments. However, in order to provide an exit route, closed-end mutual fund units are listed on stock exchanges, through which units can be sold to another investor. This route, however, sees very poor participation.

Mutual fund categories

There is no dearth to the number of schemes that each mutual fund comes out with. In order to bring in uniformity and facilitate easier comprehension for investors, SEBI has designed categories for mutual fund schemes, along with broad guidelines for each. These categories are listed below.

Equity fund categories

All equity funds have the same taxation on capital gains and dividends. The categories are listed according to the risk level involved, moving from low to high in different shades.

Debt fund categories

All debt funds have the same taxation on capital gains and dividends. The list is split based on approximate minimum holding period required. Do note that a shorter-term debt fund can be held beyond the recommended minimum timeframe. A fund meant for a long-term timeframe should not be used for short-term investment horizons.

What is Macaulay duration? Macaulay Duration is simply the time for the investment cost in a bond to be repaid based on weighted coupon payments. It plays a key role in helping debt fund investors measure the risk of the fund they are buying into.

Hybrid fund categories

Other fund categories

Click here to see the full categorization and rationalization of Mutual Funds Schemes by SEBI.

All set? Now, take a look at our Mutual fund explorer to look at various funds and their options – https://www.primeinvestor.in/prime-ratings