ICICI Pru Balanced Advantage Fund(G)-Direct Plan

View the regular plan of this scheme

Rs 72.21 0.24(0.334 %) NAV as on 16 May 2024

Scheme Objective: To provide capital appreciation and income distribution to the investors by using equity derivatives strategies, arbitrage opportunities and pure equity investments.

Performance (As on 16 May 2024)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | 11.33 % | 21.16 % | 14.05 % | 13.89 % | 13.39 % |

Portfolio

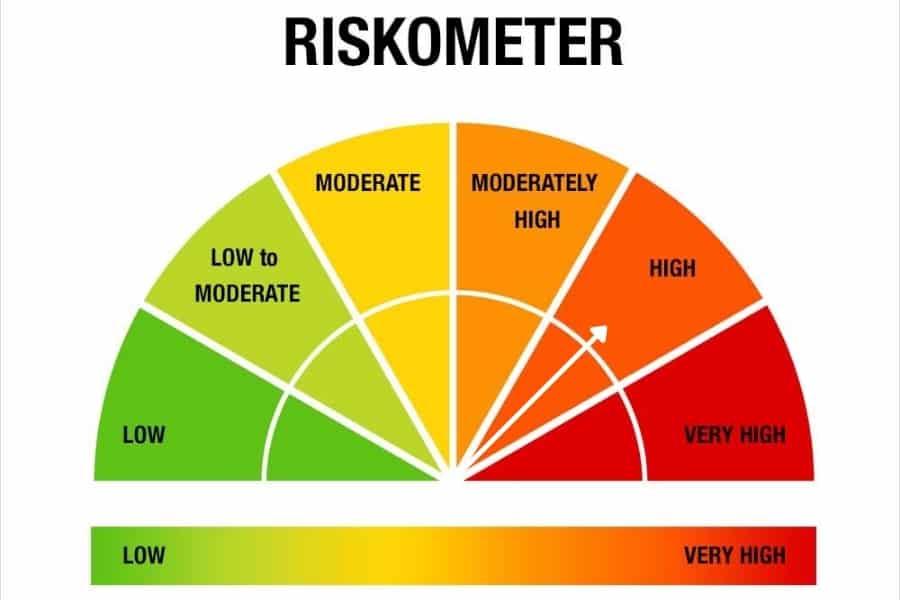

Balanced advantage funds invest in stocks, but hedge part of this exposure through derivatives. They also maintain a portion of their portfolio in debt instruments. These funds shift allocations to equity, derivatives and debt based on market movement and valuations. These funds offer lower-risk participation to equity and are less volatile than even aggressive hybrid funds.

These funds suit all investors, but especially conservative investors who wish for low-volatile equity exposure. These funds need to be held for a minimum of 1.5 years.

Short-term: Holding period is less than 12 months.

Taxation: Capital gains are taxed at 15%

Long-term: Holding period is 12 months or more.

Taxation: Capital gains up to Rs 100,000 each financial year is tax-exempt. Remaining capital gains is taxed at 10%. For investments made on or before January 31st, 2018: Capital gain up to this date is tax-free.