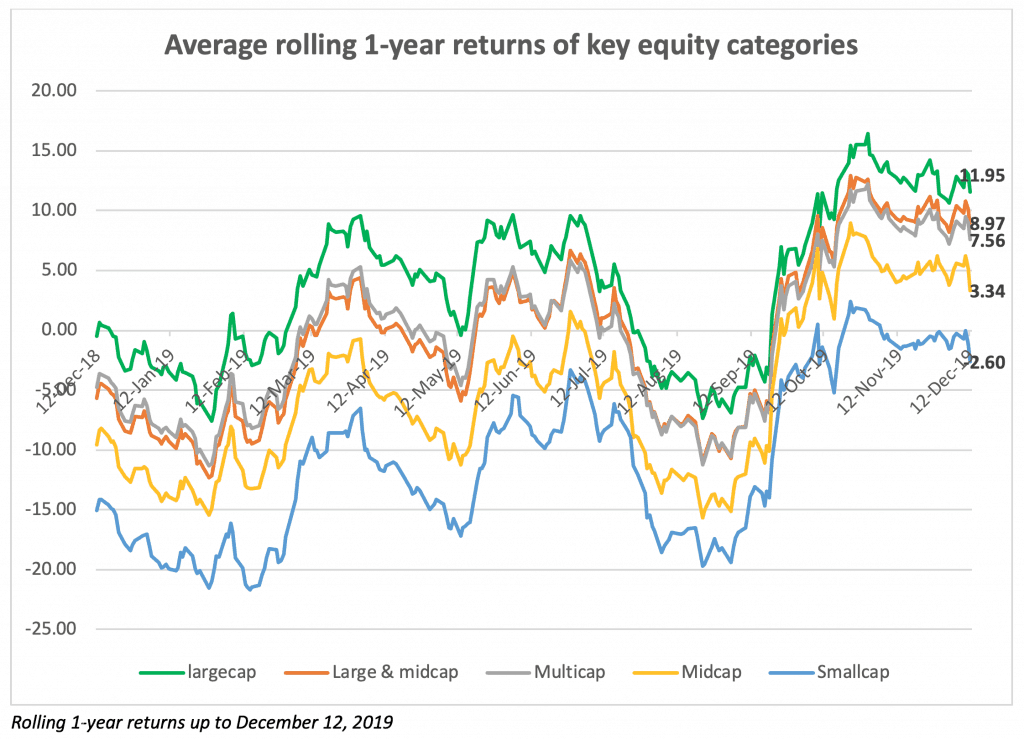

2019 was a perfect rollercoaster ride for equity funds. Through the year up to September 2019, global trade wars combined with local woes of slowdown in all key domestic economic indicators, resulted in sharp swings. The rolling 1-year return graph of equity fund categories showcases this heightened volatility.

Slash in corporate tax rates, reversal of some of the enhanced surcharge on securities, and package for real estate space were some of the dole outs that restored some amount of confidence in the economy in September 2019.

Instead of the usual point-to-point returns of funds, we want to show you how different categories of funds performed through the year and hence took the rolling returns. The other reason we put out the rolling average returns is that your 1-year returns would vary based on when you entered. Besides, some of you may also have exited this year as suggested by MF industry inflows. The graph will tell you whether your move was right.

Let’s move to the takeaways:

- Large caps stay afloat when the times get tough. But that was not the only reason for large-cap outperformance this year. It was also a case of too much money chasing too few stocks. That means the index went up and up, but your funds didn’t. While large-cap funds managed close to 12% for the year (point to point), the ups and downs meant that on an average their rolling returns was around 4%.

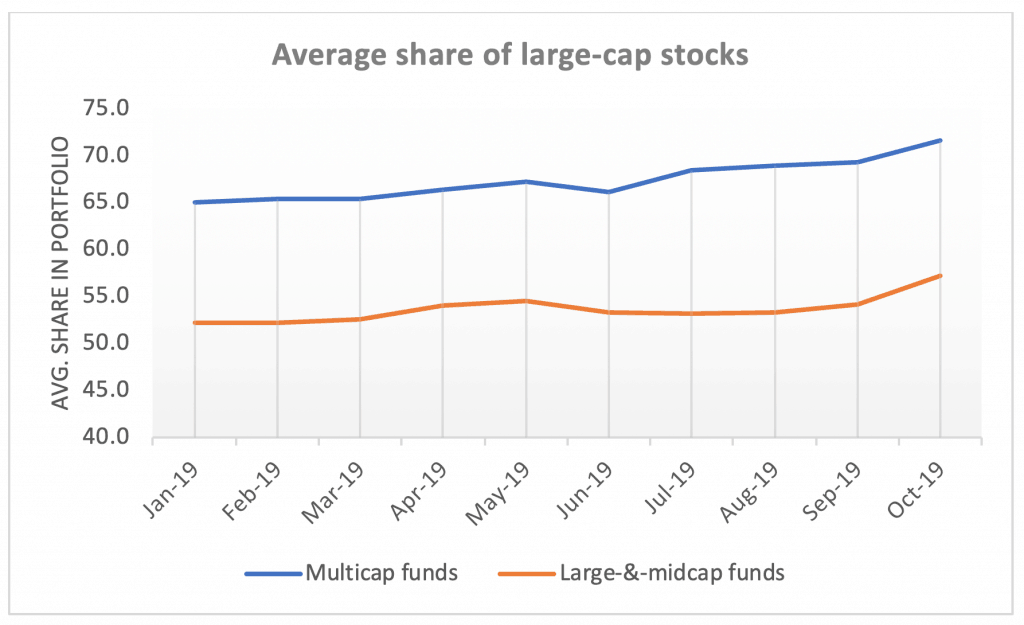

- The limited rally in stocks meant that categories such as large & midcaps and multi caps lagged. Multi caps managed a tad better, especially in the earlier part of the year when volatility was heightened. This category held more large caps than large & midcap funds as can be seen in the graph below:

- Mid and small cap funds saw some decisive up-move only after September 2019 when a slew of measures both for companies and for markets were announced by the Finance Minister. Still, those who invested in small caps in 2017 or early 2018 would still be in losses.

- The divergence in fund performance across categories was stark. In the large-cap space, for instance, funds that hugged the benchmark and took concentrated bets had a far superior performance compared with funds that held more diversified portfolios with less benchmark hugging. Axis Blue chip’s average 1-year return of 10.3% versus ABSL Frontline Equity’s return of just 1.6% is an example. Similarly, in categories such as small cap, funds that safely held as much as 20% cash managed positive returns through the year as they were less prone to the small-cap equity hits.

- Despite the high performance in large caps the category continued to struggle to beat the Nifty 100 TRI as well as Nifty 50 TRI. Investors who hugged the index would have done better. In the large and midcap and multi-cap category though, holding either a value strategy or bias for midcaps hurt fund performance compared with the index. But mid and small-cap funds, thanks to their leeway to hold larger companies or hold cash, did far better than the indices in containing declines.

Category-wise rolling 1-year returns (%)

| Min. returns | Max. returns | Avg. returns | |

| Large cap | -7.56 | 16.43 | 3.62 |

| Nifty 100 TRI | -7.37 | 16.81 | 5.70 |

| Large & Midcap | -12.33 | 12.96 | -0.71 |

| Nifty 500 TRI | -10.42 | 14.00 | 2.14 |

| Multi cap | -11.33 | 12.26 | -0.51 |

| Nifty 500 TRI | -10.42 | 14.00 | 2.14 |

| Midcap | -15.67 | 9.00 | -5.44 |

| Nifty Midcap 100 TRI | -21.85 | 1.51 | -9.47 |

| Small cap | -21.65 | 2.42 | -11.02 |

| Nifty Smallcap 100 TRI | -33.51 | -0.45 | -19.06 |

Returns up to December 12, 2019

- When Indian markets perform poorly, international diversification helps. The table below shows some of the top returning international funds. Interestingly, while US has traditionally helped when Indian markets struggled, this time around, even Asian markets, including China as well as Japan managed outperformance.

International funds – 2018 & 2019

| 2018 | 2019* | |

|---|---|---|

| Edelweiss Greater China Equity Offshore Fund | -17.55 | 41.93 |

| Motilal Oswal Nasdaq 100 FOF | — | 32.68 |

| ICICI Prudential US Bluechip Equity Fund | 5.12 | 31.32 |

| Kotak World Gold Fund | -12.73 | 30.77 |

| Franklin India Feeder – Franklin U.S. Opportunities Fund | 6.46 | 29.62 |

| HSBC Global Consumer Opportunities Fund | -8.47 | 29.04 |

| Principal Global Opportunities Fund | -15.38 | 27.35 |

| PGIM India Global Equity Opportunities Fund | 0.26 | 26.27 |

| DSP World Gold Fund | -10.6 | 26.24 |

| Franklin Asian Equity Fund | -13.55 | 25.65 |

| Edelweiss US Value Equity Offshore Fund | -3.72 | 25.52 |

| Nippon India Japan Equity Fund | -3.76 | 23.37 |

*Returns till December 12, 2019

The past few years have shown that 1-year returns do not serve as guideposts to make your entry. Then why are we showcasing it? Simply for you to know the following:

- Investing excessively based on midcap/small cap returns in 2017/18 would have hurt your portfolio badly in 2018/19. The same can be said of over-valued pockets of large caps now. Instead of trying to time market-cap classes, a diversified approach across market cap can help participate as well as contain falls.

- Some amount of exposure outside India can help ride rupee depreciation and gain from other markets too.

- If you had been among the many (as data points) who exited the markets just as markets picked up in September, you would know patience is the key.

- And above all, last year’s winners rarely make a repeat performance. So, stop looking for chart toppers and start looking at consistency!

So what should be your picks and what kind of portfolios should you build? Look out for our picks and our portfolios (both mutual funds and ETFs) when we go live with our products. And 2020 will have our outlook and strategy, exclusively for our subscribers! Stay tuned!

10 thoughts on “How did equity funds perform in 2019?”

Hi Vidya,

How can arrive at the below conclusion which you have mentioned in the article

“If you had been among the many (as data points) who exited the markets just as markets picked up in September, you would know patience is the key.”

Replied in the ticket (mail) we received. Thanks, Vidya

Hi Vidya

Good morning.

My portfolio consists of direct equity such as L&T finance, Sundaram holding, HDFC life etc ( sizeable qty) bought at a high price. Can I book loss and buy Equity MF,. balanced fund or ETF as of late,. I am unable to bear volatility. I am a senior citizen and does not depend this money for living. However, erosion of portfolio causes pain. Sorry to bother you with a different type of query. Kindly advice

Regards

Sankar N

Hello Sir, equity mutual funds (nor balanced funds) will not remove the volatility in your portfolio. At best they may reduce it. If you do not want any volatility, low-risk debt funds and FDs are your best bet. If you are ok with some volatility then multi-cap equity fund and ETFs are fine. Please wait for some more time to get our list of recommended products in debt, FDs, and in equity funds. If you are registered, we will alert you when our products go live. regards, Vidya

Good write up. It looks increasingly certain that indexing in large cap space will get better and better in years to come. Active funds may be right only in multi cap space and if required Midcap space(risky bet).

Too early to call that active funds are done in the large cap or multicap space. Nifty did well due to the top few stocks. This too shall pass. Even if it doesn’t, now is not the time to conclude. We need to see it for a few more years.

Hello Sir, Please look at the longer term performance here: https://www.primeinvestor.in/2019/11/08/large-cap-funds-are-losing-the-appeal/ Thanks, Vidya

Good post.

What this post indicates is a couple of multicaps would be sufficient for an investor who doesn’t track markets everyday. A good multicap fund manages the shifts in market cycle which would be too difficult for a normal investor to do.

A focused fund also is attractive with focused bets on high conviction stocks.

Maybe you could have included Multicaps with International exposure in the list.

Regards,

If you mean local funds that have international exposure..they are already included in multicap. They won’t fall under intrnational. International category. Intl. funds have been listed separately. Thanks, Vidya

Comments are closed.