Quarterly Review – Changes to Prime Portfolios

Quarterly review and changes to Prime Portfolios – a set of eighteen unique portfolios that meet several investor timeframes and needs.

Quarterly review and changes to Prime Portfolios – a set of eighteen unique portfolios that meet several investor timeframes and needs.

All your questions on reviewing your MF portfolio, covering frequency, spotting under-performers and dealing with them, answered here.

With the Sensex zooming past 70k, if you are wondering whether to book profits, then you should read this.

Taking a loan against mutual fund investments without breaking them can seem like an attractive option to tide over a temporary cash crunch. Aarati Krishnan evaluates the merits of this financing arrangement.

Gilt funds vs constant maturity funds – they may share several similarities but which one should you choose? Find out here!

The removal of indexation benefits for debt funds, has led many investors to look for alternatives. Are hybrid funds the answer? Find out here.

A performance review of Prime Portfolios – our readymade portfolios – and changes we’ve made this quarter.

In this quarterly review of Prime Funds and Prime ETFs, we have made very few changes. Nevertheless, stay updated!

Wondering where to fit passive equity funds in your portfolio? This article will show you 6 scenarios that are best suited for passive equity funds.

Now that debt fund taxation is no longer as attractive as it used to be, should you be replacing them with arbitrage funds instead. Find out if the tax aspect alone is enough to base this decision on.

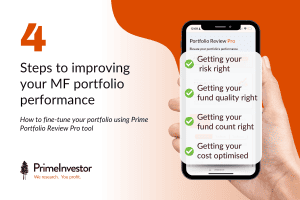

How to fine-tune your portfolio using Prime Portfolio Review Pro tool

While long-term returns are the best when analysing mutual fund performance,

there are certain situations where short-term returns become important.

Legal Disclaimer : PrimeInvestor Financial Research Pvt Ltd (with brand name PrimeInvestor) is an independent research entity offering research services on personal finance products to customers. We are a SEBI registered Research Analyst (Registration: INH200008653). The content and reports generated by the entity does not constitute or is not intended to constitute an offer to buy or sell, or a solicitation to an offer to buy or sell financial products, units or securities. All content and information are provided on an ‘as is’ basis by PrimeInvestor Financial Research Pvt Ltd. Information herein is believed to be reliable but PrimeInvestor Financial Research Pvt Ltd does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. The services rendered by PrimeInvestor Financial Research Pvt Ltd are on a best-effort basis. PrimeInvestor Financial Research Pvt Ltd does not assure or guarantee the user any minimum or fixed returns. PrimeInvestor Financial Research Pvt Ltd or any of its officers, directors, partners, employees, agents, subsidiaries, affiliates or business associates will not liable for any losses, cost of damage incurred consequent upon relying on investment information, research opinions or advice or any other material/information whatsoever on the web site, reports, mails or notifications issued by PrimeInvestor Financial Research Pvt Ltd or any other agency appointed/authorised by PrimeInvestor Financial Research Pvt Ltd. Use of the above-said information is at the user’s own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. All intellectual property rights emerging from this website, blog, and investment solutions are and shall remain with PrimeInvestor Financial Research Pvt Ltd. All material made available is meant for the user’s personal use and such user shall not resell, copy, or redistribute the newsletter or any part of it, or use it for any commercial purpose. PrimeInvestor Financial Research Pvt Ltd, or any of its officers, directors, employees, or subsidiaries have not received any compensation/ benefits whether monetary or in kind, from the AMC, company, government, bank or any other product manufacturer or third party, whose products are the subject of its research or investment information. The performance data quoted represents past performance and does not guarantee future results. Investing in financial products involves risk. Investments are subject to market risk. Please read all related documents carefully. As a condition to accessing the content and website of PrimeInvestor Financial Research Pvt Ltd, you agree to our Terms and Conditions of Use, available here. This service is not directed for access or use by anyone in a country, especially the USA, Canada or the European Union countries, where such use or access is unlawful or which may subject PrimeInvestor Financial Research Pvt Ltd or its affiliates to any registration or licensing requirement.

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Compliance Officer Details: Name: Srikanth Meenakshi; Email: contact@primeinvestor.

Grievance Officer Details: Name: Srikanth Meenakshi; Email: contact@primeinvestor.

Equity funds: Large Cap Funds | Mip Cap Funds | Large And Mid Cap Funds | Small Cap Mutual Funds | Contra Mutual Funds | Dividend Yield | Focused Mutual Funds | Find Top Index Funds | Best Sector Funds | Thematic Mutual Fund | Best Value Mutual Funds | Equity Linked Savings Scheme | Tax Saving Funds

Debt funds: Banking And PSU Funds | Corporate Bond Funds | Credit Risk Funds Mutual Funds | Dynamic Bond Funds | Floating Rate Funds | Gilt Mutual Funds India | Find Top Liquid Funds In India | Long term debt funds | Low Duration Funds Debt Funds | Medium Duration Debt Funds | Medium To Long Duration Funds | Money Market Debt Funds | Overnight Debt Funds | Short Duration Debt Funds | Ultra Short Term Debt Fund

Hybrid funds: Aggressive Hybrid Funds | Arbitrage Mutual Funds | Balanced Advantage Mutual Funds | Conservative Hybrid Funds | Dynamic Asset Allocation | Equity Saving Funds | Multi Asset Funds | Multi Asset Allocation

Mutual fund rolling returns by category: Balanced Advantage | Conservative Hybrid Fund | Corporate Bond | Dividend Yield | Dynamic Bond | Equity Linked Savings Scheme | Floating Rate | Index Funds | Large and Midcap fund | Large Cap Fund | Liquid funds | Low Duration | Mid Cap Fund | Multi Cap Fund | Short Duration | Small cap Fund | Solution Oriented – Childrens Fund | Ultra Short Duration

Stocks by market-cap:

Large Cap Stocks |Mid Cap Stocks |Small Cap Stocks

Stocks by sector:

Auto |Auto & auto ancillaries |Banks |Capital goods |Cement |Chemicals |Construction & infrastructure |Consumer discretionary |Consumer durables |

E-commerce |Entertainment |Fertilizers |Finance |FMCG |Hotels & restaurants |IT |Jewellery |Logistics |Media |Metals & mining |Oil & gas |Packaging |Paper |Pharma & healthcare |Plastic products |Power |Realty |REIT |Retail |Sugar |Telecom |Textiles |Trading

Popular stocks:

Reliance Industries Ltd |Tata Consultancy Services Ltd |HDFC Bank Ltd |Hindustan Unilever Ltd |Infosys Ltd |Housing Development Finance Corporation Ltd |Kotak Mahindra Bank Ltd |ICICI Bank Ltd |Bajaj Finance Ltd |Bharti Airtel Ltd |ITC Ltd |Asian Paints Ltd |HCL Technologies Ltd |State Bank of India |Maruti Suzuki India Ltd

Get access to fresh stocks and mutual funds recommendations.